Introduction

The commercial real estate market is constantly evolving, making data-driven insights essential for investors. Real Estate Shops for Rent Datasets provide crucial information on rental prices, market demand, location trends, and property availability. Studies show that commercial rental prices fluctuate by 10-15% annually, influenced by economic trends and urban development.

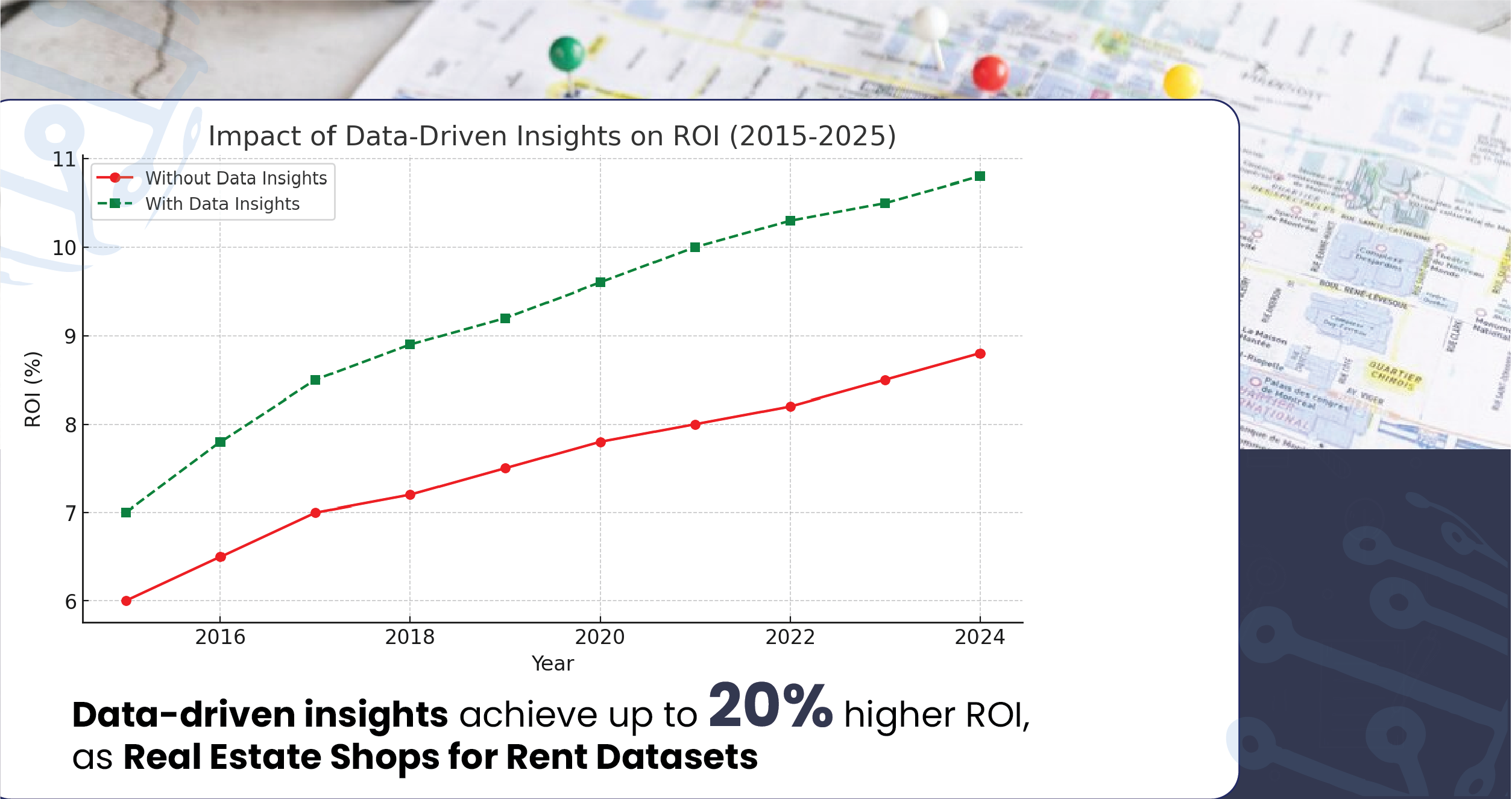

By leveraging Web Scraping Real Estate Data, investors can access Real Estate Property Datasets to analyze market fluctuations, identify high-demand areas, and optimize rental investments. Additionally, Commercial Real Estate Datasets help track price trends, compare different localities, and assess long-term profitability. Research indicates that data-driven real estate investments yield up to 20% higher returns than traditional approaches.

Stay ahead in the market by utilizing Real Estate Shops for Rent Datasets to make well-informed investment decisions. This blog explores how real estate data can maximize your rental investment potential.

What are Real Estate Shops for Rent Datasets?

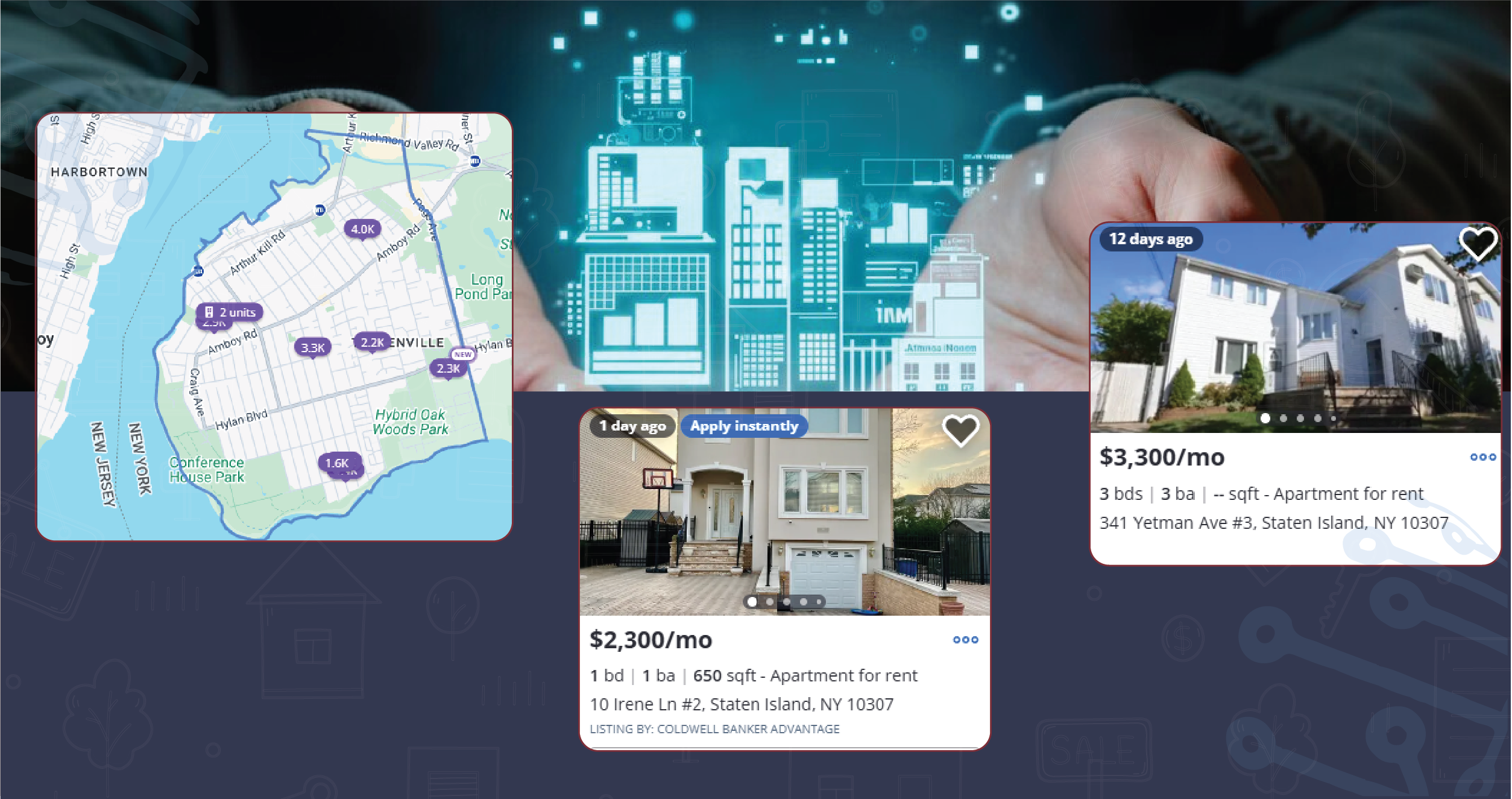

Real Estate Shops for Rent Datasets are comprehensive data collections that provide insights into the commercial rental market. These datasets include key information such as rental prices, property availability, location trends, demand patterns, and lease terms. By utilizing Web Scraping Real Estate Data, investors can access real-time updates on Real Estate Property Datasets, helping them make informed decisions.

These datasets are crucial for analyzing Commercial Real Estate Datasets, enabling businesses and investors to identify profitable locations, compare rental trends, and optimize investment strategies. Leveraging this data ensures better market analysis and maximized rental returns.

Importance of Real Estate Shops for Rent Datasets for Commercial Property Investors

Real Estate Shops for Rent Datasets are essential for commercial property investors as they provide critical insights into rental prices, market demand, location trends, and property availability. By leveraging Web Scraping Real Estate Data, investors can track Real Estate Property Datasets to analyze market fluctuations and identify high-yield locations.

These Commercial Real Estate Datasets help investors compare rental rates, assess tenant demand, and make data-driven decisions to maximize returns. Studies show that investors using data analytics achieve up to 20% higher ROI. Accessing real-time property data ensures strategic investments and long-term profitability in the competitive real estate market. Let’s understand its points in detail:

Market Trends & Demand Analysis

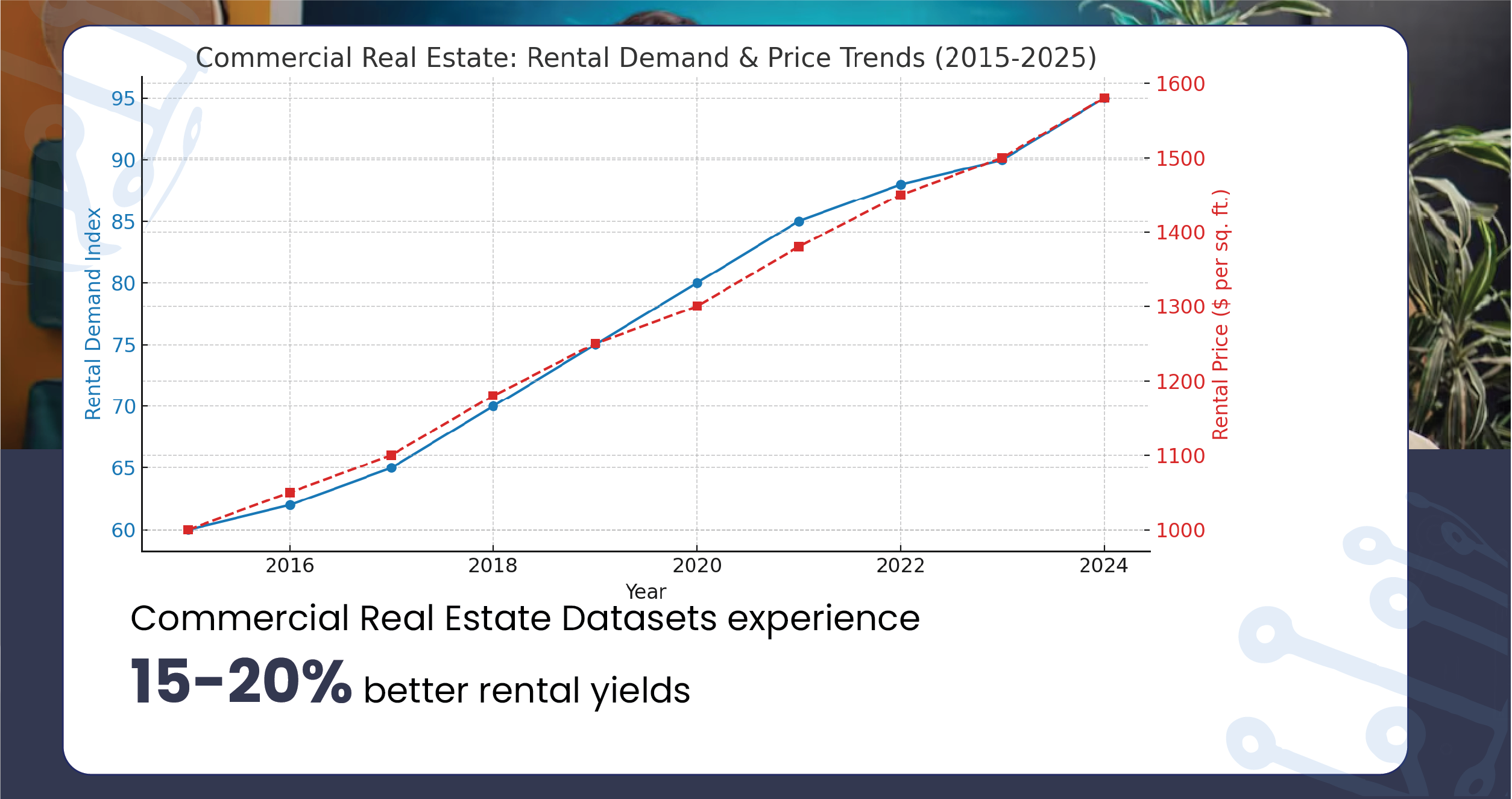

Understanding market trends is crucial for investors to assess rental demand and maximize returns. By analyzing Real Estate Property Datasets, investors can track rental price fluctuations, high-demand locations, and vacancy rates to make informed decisions.

Market Insights from Real Estate Shops for Rent Datasets

| Market Metric | Data Extracted |

|---|---|

| Average shop rental price | $1,500 - $3,000 per month |

| High-demand locations | Downtown, shopping malls, commercial hubs |

| Rental price fluctuations | 5-10% seasonal changes |

| Vacancy rates in prime areas | 8-12% |

| Shops in prime locations leased within | 30-45 days |

By leveraging Scrape Commercial Rental Listings Data, investors can gather real-time data to identify profitable properties. Web Scraping Shops for Rent with Size and Price helps compare listings based on area and rental cost, ensuring better investment choices. Additionally, Scrape Commercial Properties for Rent by Square Meter allows investors to analyze price variations based on shop size.

Key Insight: Studies show that investors who utilize Commercial Real Estate Datasets experience 15-20% better rental yields due to strategic decision-making. Tracking rental demand and price trends ensures optimized investment opportunities in a dynamic real estate market.

Competitive Rental Pricing Analysis

Analyzing rental prices across different locations is essential for investors to stay competitive and optimize rental income. By using Scrape Shop Rental Prices by Location, businesses can compare prices in various commercial zones and make data-driven decisions.

Rental Price Comparison by Location

| Location | Average Rent per Sq. Meter |

|---|---|

| City Center | $50 - $70 |

| Suburban Areas | $30 - $45 |

| Shopping Malls | $80 - $120 |

| Industrial Zones | $20 - $35 |

Utilizing Web Scraping Services for Real Estate Data

Utilizing Web Scraping Services allows investors to collect real-time pricing data from multiple sources, ensuring accurate market analysis. Mobile App Scraping Services further enhance insights by gathering rental listings from mobile applications, offering a broader view of pricing trends. Additionally, Web Scraping API Services streamline data extraction, enabling investors to automate pricing analysis and track market shifts efficiently.

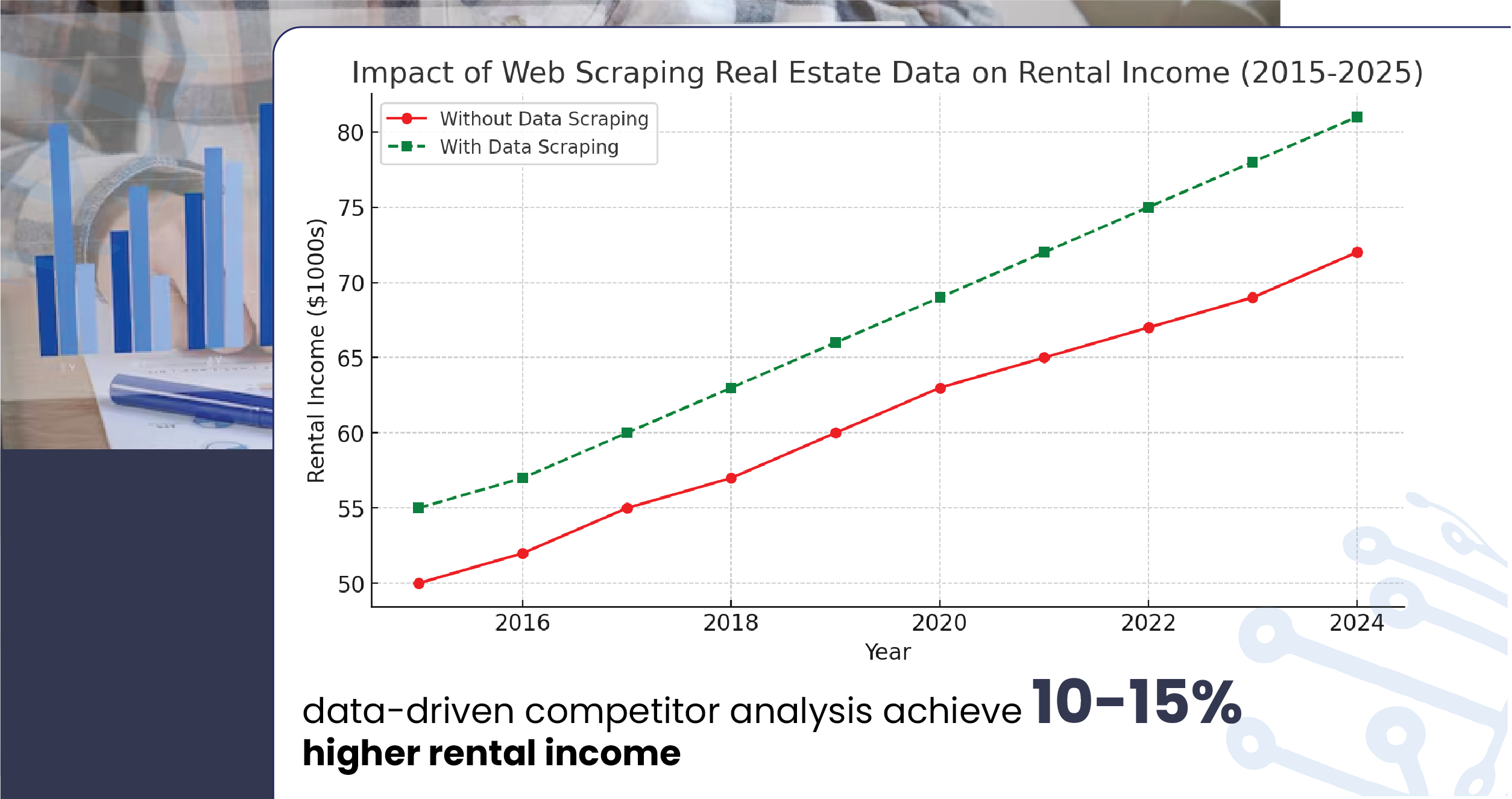

Key Insight: Investors who leverage Scrape Commercial Rental Listings Data can set competitive pricing strategies, adapt to market trends, and achieve 10-15% higher rental income by aligning rental rates with demand and location-based pricing insights.

Location-Based Investment Insights

Choosing the right location is critical for rental profitability. By leveraging Web Scraping Shops for Rent with Size and Price, investors can extract valuable insights from Real Estate Shops for Rent Datasets to evaluate high-demand areas and maximize returns.

Key Location Factors Impacting Rental Value

| Factor | Impact on Rental Value |

|---|---|

| Proximity to transport | 20-30% higher rental demand |

| Foot traffic density | Directly correlates to pricing |

| Nearby business types | Determines tenant preferences |

| Development projects | Long-term rental appreciation |

By utilizing Real Estate Property Datasets, investors can analyze market demand, pricing trends, and location-based growth potential. Web Scraping Real Estate Data enables data collection from multiple sources, providing a competitive edge in the commercial rental market.

Additionally, Commercial Real Estate Datasets help investors assess tenant preferences, rental stability, and property appreciation over time. Scrape Commercial Properties for Rent by Square Meter allows investors to compare prices based on shop size and location, ensuring optimal investment decisions.

Key Insight: Investors using data-driven insights achieve up to 20% higher ROI, as Real Estate Shops for Rent Datasets help identify high-yield locations with strong rental potential.

Rental Yield & ROI Calculation

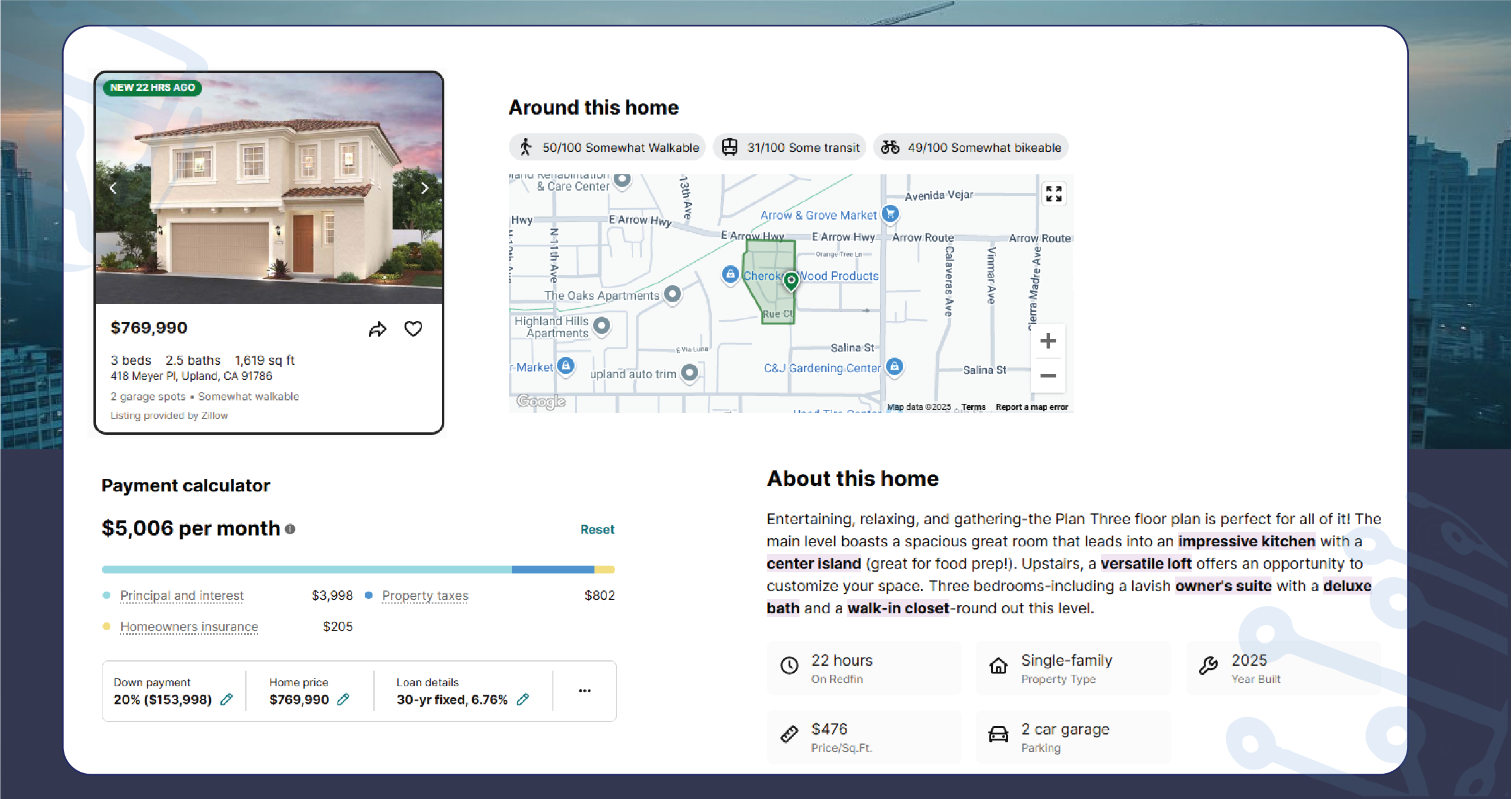

Assessing return on investment (ROI) is crucial for investors to determine the profitability of commercial real estate. By leveraging Web Scraping Services, investors can access real-time data on rental yields, property prices, and market trends to make informed decisions.

Key Metrics for Rental Yield Calculation

| Metric | Example Calculation |

|---|---|

| Annual Rental Income | $36,000 (for a $3,000/month shop) |

| Property Purchase Price | $400,000 |

| Rental Yield (%) | 9% (Annual Rent / Purchase Price) |

| ROI Growth Rate | 5-7% per year |

By using Web Scraping API Services, investors can automate rental price tracking, ensuring they stay competitive in the market. Additionally, analyzing rental trends and property values through Web Scraping Services helps optimize rental income and predict future ROI growth.

Key Insight: Investors leveraging data-driven insights from Web Scraping API Services can improve rental yield optimization, minimize risks, and achieve sustainable long-term returns in the commercial real estate sector.

Competitor Analysis & Market Positioning

Understanding competitor strategies is essential for investors to position their rental properties effectively. By using Mobile App Scraping Services , investors can track rental prices, lease terms, occupancy rates, and promotional offers to stay competitive in the market.

Key Competitor Insights from Web Scraping

| Competitor Data | Extracted Insights |

|---|---|

| Competitor rental prices | Identify pricing gaps |

| Lease terms & conditions | Adjust contract flexibility |

| Occupancy rates | Gauge market demand |

| Promotional offers | Competitive positioning |

By leveraging Web Scraping Real Estate Data, investors can monitor pricing trends and modify rental strategies to maximize occupancy rates. Additionally, Real Estate Shops for Rent Datasets help assess market demand, ensuring properties remain attractive to potential tenants.

Analyzing Real Estate Property Datasets allows investors to identify high-performing areas and refine their offerings to meet tenant preferences. With Commercial Real Estate Datasets, investors can enhance marketing strategies, optimize rental pricing, and attract premium tenants.

Key Insight: Investors who use data-driven competitor analysis achieve 10-15% higher rental income, as Web Scraping Real Estate Data enables strategic market positioning and improved tenant acquisition.

Why Choose ArcTechnolabs?

ArcTechnolabs is a leading provider of real estate data solutions, offering advanced Web Scraping Services to help investors and businesses make informed decisions. Our expertise in extracting Real Estate Shops for Rent Datasets ensures accurate and up-to-date insights into rental prices, market trends, and property availability.

Why ArcTechnolabs Stands Out?

Comprehensive Data Extraction – We provide Real Estate Property Datasets with detailed insights into shop sizes, rental prices, lease terms, and high-demand locations.

Advanced Analytics – Our data solutions include Commercial Real Estate Datasets that help investors analyze rental yields, ROI potential, and competitor pricing strategies.

Customizable Web Scraping Solutions – Whether you need real-time data from property listings, rental marketplaces, or competitor websites, our solutions can be tailored to your needs.

Accurate & Real-Time Updates – Stay ahead of market fluctuations with up-to-date Real Estate Shops for Rent Datasets, enabling better investment decisions and pricing strategies.

Seamless Integration – Our data can be easily integrated into CRM, BI tools, and analytics platforms for efficient decision-making.

Conclusion

Leveraging Real Estate Shops for Rent Datasets is essential for making informed investment decisions in the competitive commercial real estate market. By utilizing Real Estate Property Datasets and Commercial Real Estate Datasets, investors can analyze rental trends, competitor pricing, and location-based insights to maximize returns.

With Web Scraping Real Estate Data, businesses gain access to real-time market intelligence, ensuring strategic investments and optimized rental pricing.

Partner with ArcTechnolabs today to access powerful real estate data solutions and stay ahead in the commercial rental market! Contact us now to get started.